The transportation industry prepares for disruption as autonomous technology advances.

Transportation not only takes people and goods from here to there, but shapes our society, influencing choices on where to live, work, travel or shop. Once-futuristic autonomous vehicles are now poised to disrupt the transportation industry. Everyone understands that autonomous automobiles, trains, drones and helicopters will change transportation in and around our cities, but no one yet has a clear picture of when or how it will change.

“Mobility providers like Uber and Lyft, truck and auto OEMs, and technology companies are all trying to figure that out,” said Jeremy Carlson, principal analyst for autonomous driving at London-based IHS Markit.

MARKET DRIVERS FOR AUTOMATION

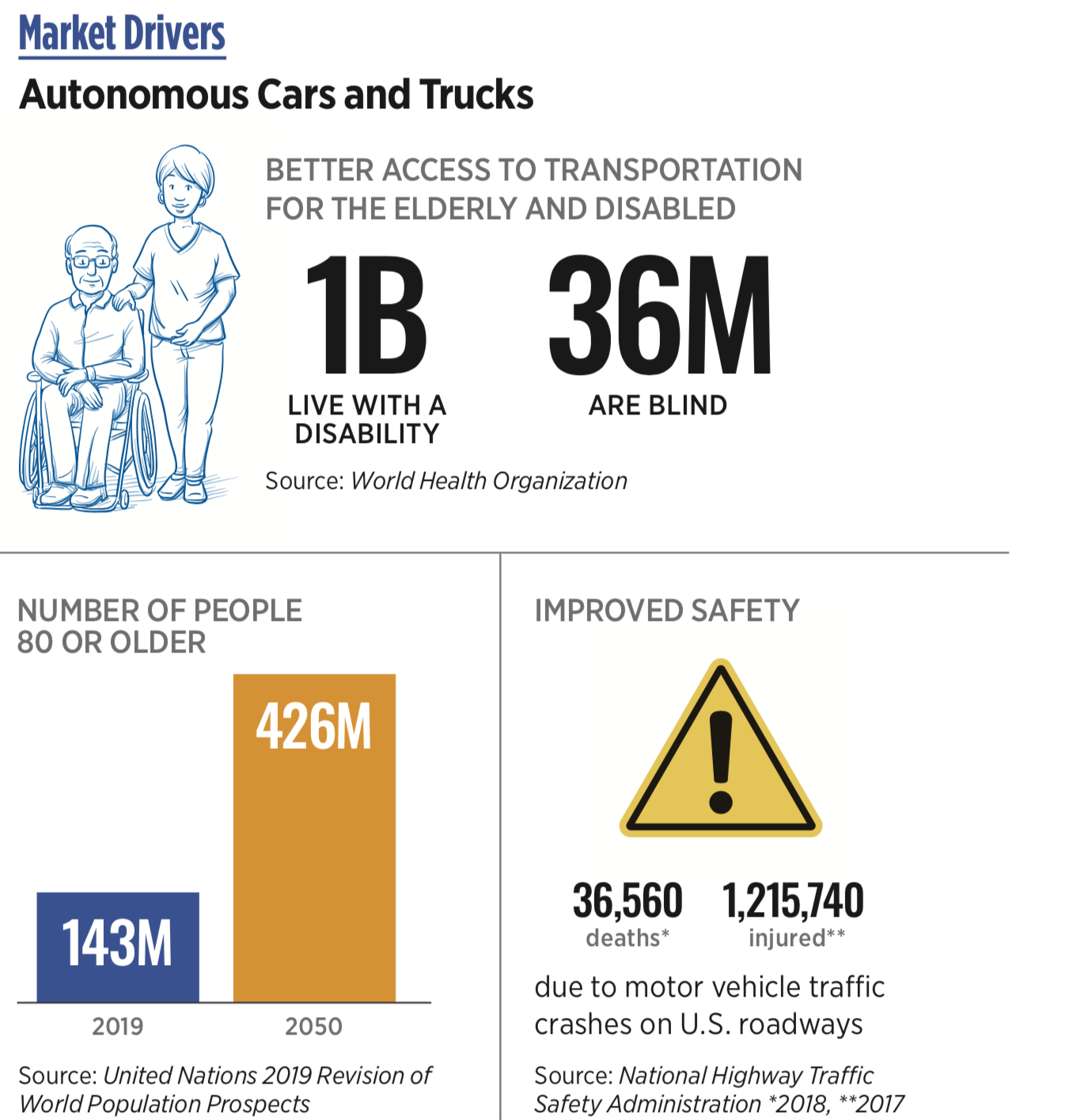

Safety provides a strong incentive to deploy autonomous vehicles. Autonomous vehicles could help reduce the huge number of fatalities and injuries that occur on the road each year. They also could improve access to transportation for more than 1 billion people with disabilities and aging populations worldwide, opening up new markets for vehicles and mobility as a service (MaaS).

“More than 33 million autonomous vehicles will be sold globally in 2040, a huge increase from the 51,000 units forecast for the first year of significant volume in 2021, according to the latest report from IHS Markit. Autonomous ride hailing services, Carlson said, will drive early deployment and growth, before personal autonomous vehicles (AVs).

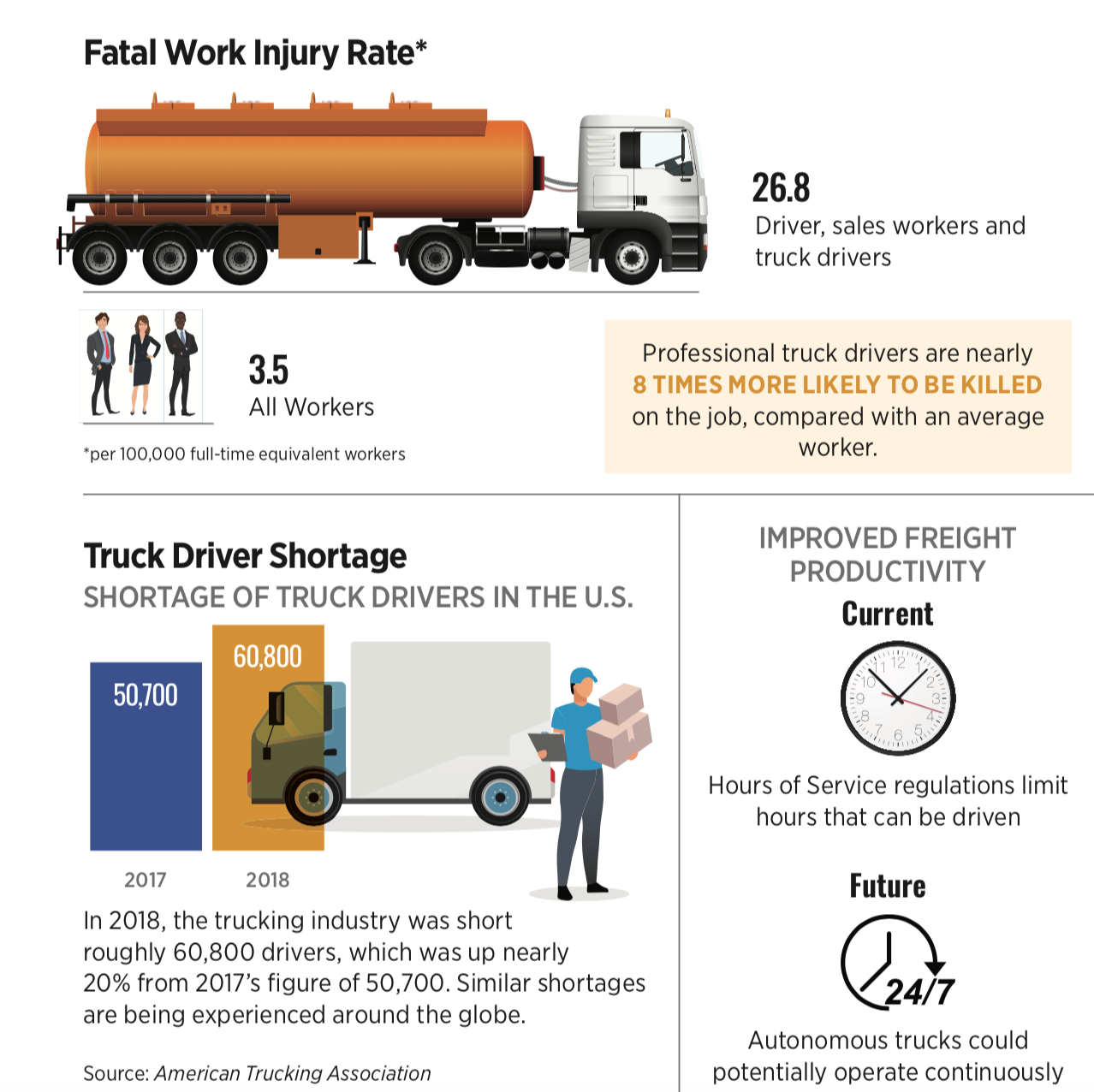

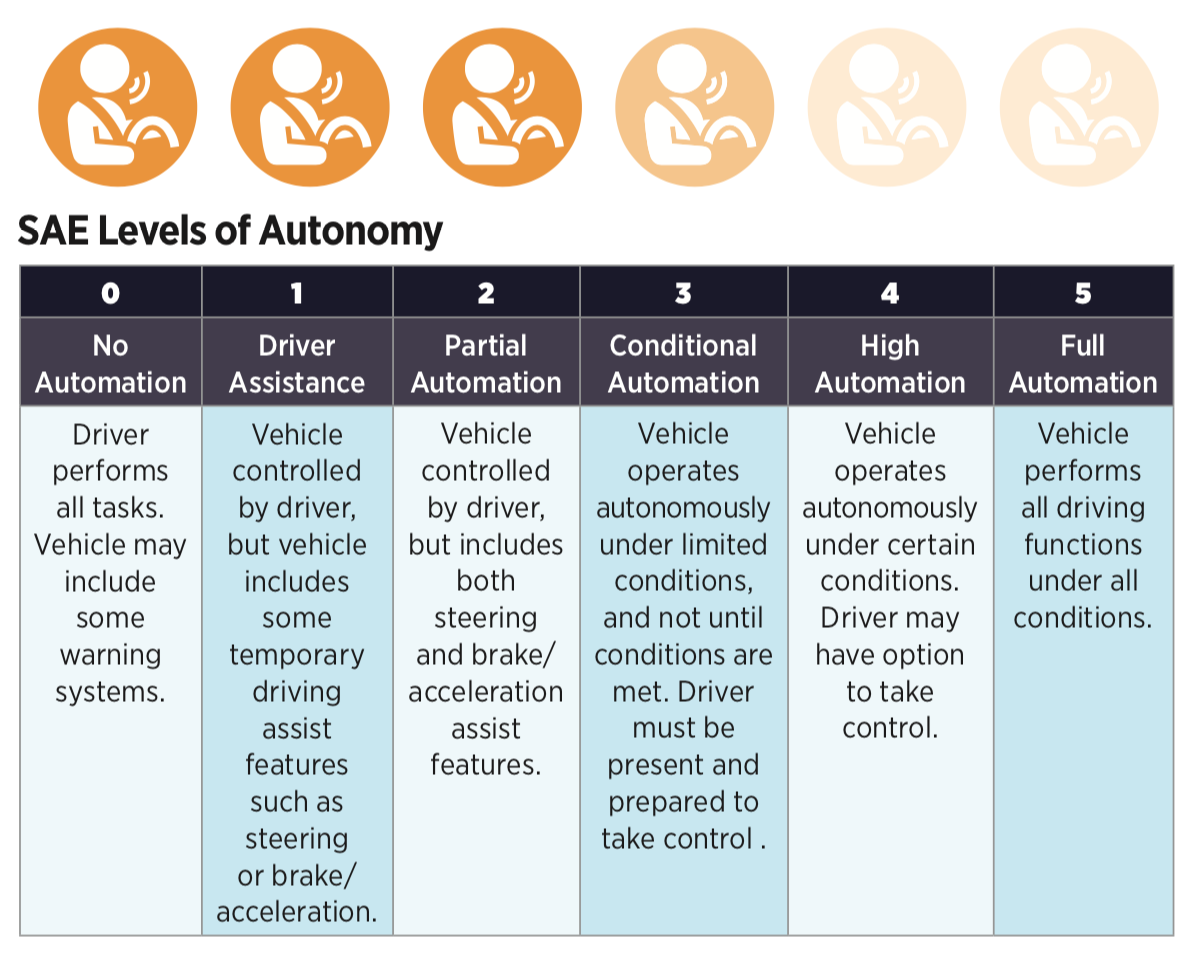

Trucking is another segment that may be among the first to have high (Level 4) or full (Level 5) automation in commercial applications. Trucking companies have a vested interest in improving safety, enhancing fleet productivity and finding a solution to a shortage of long-haul drivers. The ability to operate vehicles 24 hours a day while simultaneously eliminating the cost of the driver is expected to reduce costs considerably.

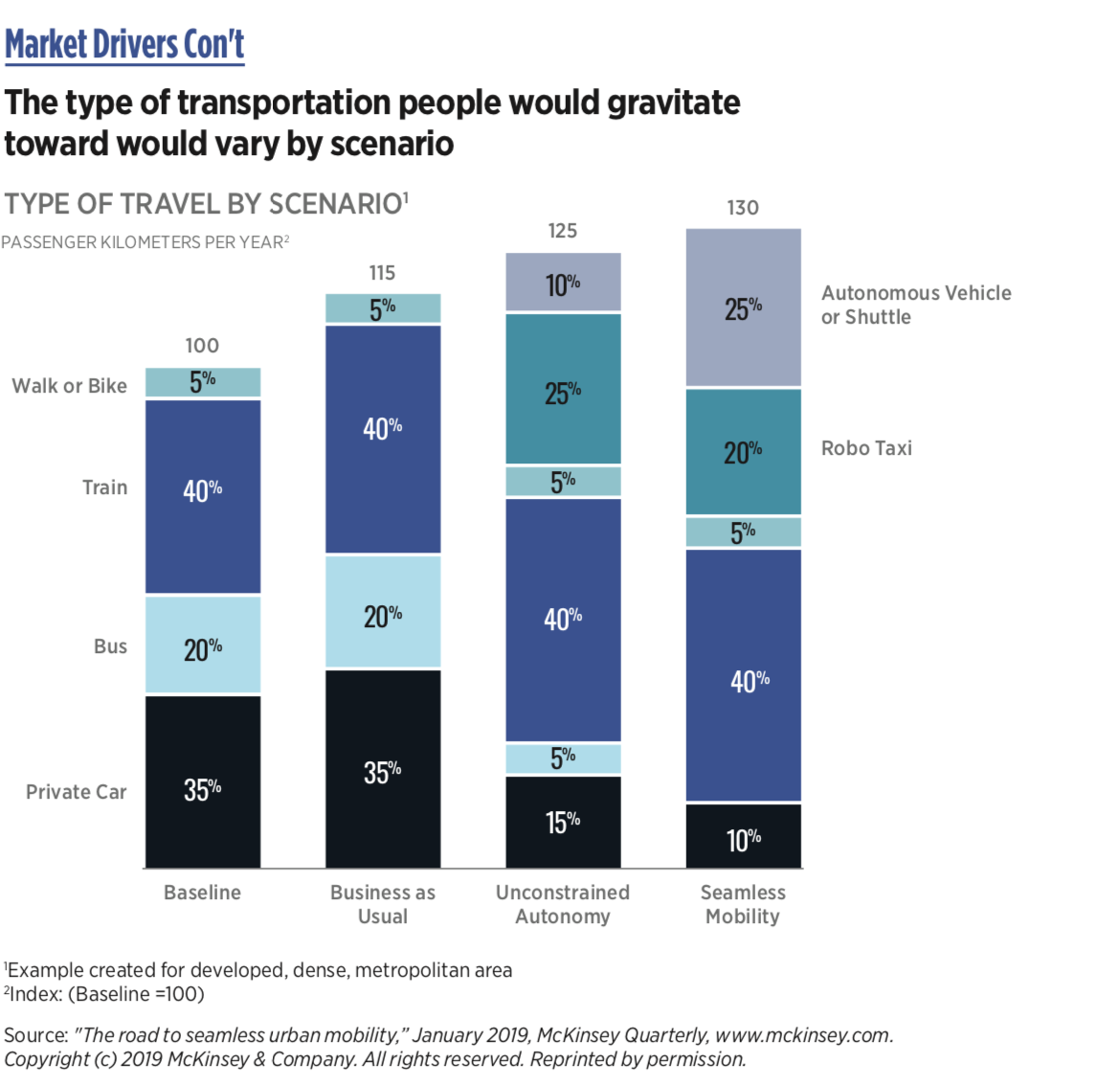

URBAN MOBILITY SCENARIOS

The McKinsey & Company report, “The road to seamless urban mobility,” analyzes models beyond “business as usual urbanization.” In the “Unconstrained Autonomy” model (see the “Type of Travel by Scenario” chart on page 28), travelers will adopt robo-taxis for about 25 percent of their travel by 2030, with costs on par with owning a private vehicle. A more pronounced “Seamless Mobility” scenario includes an array of technologies: robo-taxis, autonomous shuttles, intelligent traffic systems, advanced rail signaling and predictive maintenance. In 2030, private cars and robo-taxis would provide about 30 percent of passenger-kilometers compared with 35 percent for private cars today, while pooled AV shuttles could take 25 percent of the market, more than twice that of the “Unconstrained Mobility” scenario. Congestion would be reduced even as more travel could be accommodated.

Either of these models represents a monumental shift in behavior, and, as a 2019 automated vehicle survey from AAA suggests, consumers may not yet be ready for autonomous vehicles. Seventy-one percent of respondents indicate they are afraid to ride in fully self-driving vehicles. About half (53 percent) are comfortable with low-speed, short-distance forms of transportation such as people movers, and 44 percent are comfortable with fully self-driving vehicles for delivery of food or packages. Carlson expects hands-on experience with autonomous vehicle ride-sharing to improve consumer confidence.

Cost could greatly impact whether travelers choose vehicle ownership over other options, Carlson said. “The cost of mobility as a service versus the cost per mile for an owned vehicle is difficult to predict,” he said. “Technology costs for L4 autonomy are likely to be significant.”

The local nature of transportation is also a factor in travel decision-making. If a city doesn’t have a reliable transit network, it makes it more difficult for travelers to give up access to an owned vehicle.

IHS Markit predicts that legislation related to autonomous vehicle testing and operation will be industry-friendly. Most U.S. states have enacted some form of legislation or executive order related to the testing and deployment of autonomous vehicles, and the U.S. Department of Transportation has recognized that it must modernize or eliminate outdated regulations. Autonomous vehicle testing is underway in more than 50 cities around the globe. Cities in China and Japan have increased support for AV testing; by 2030, China expects fully autonomous vehicles to account for 10 percent of car sales.

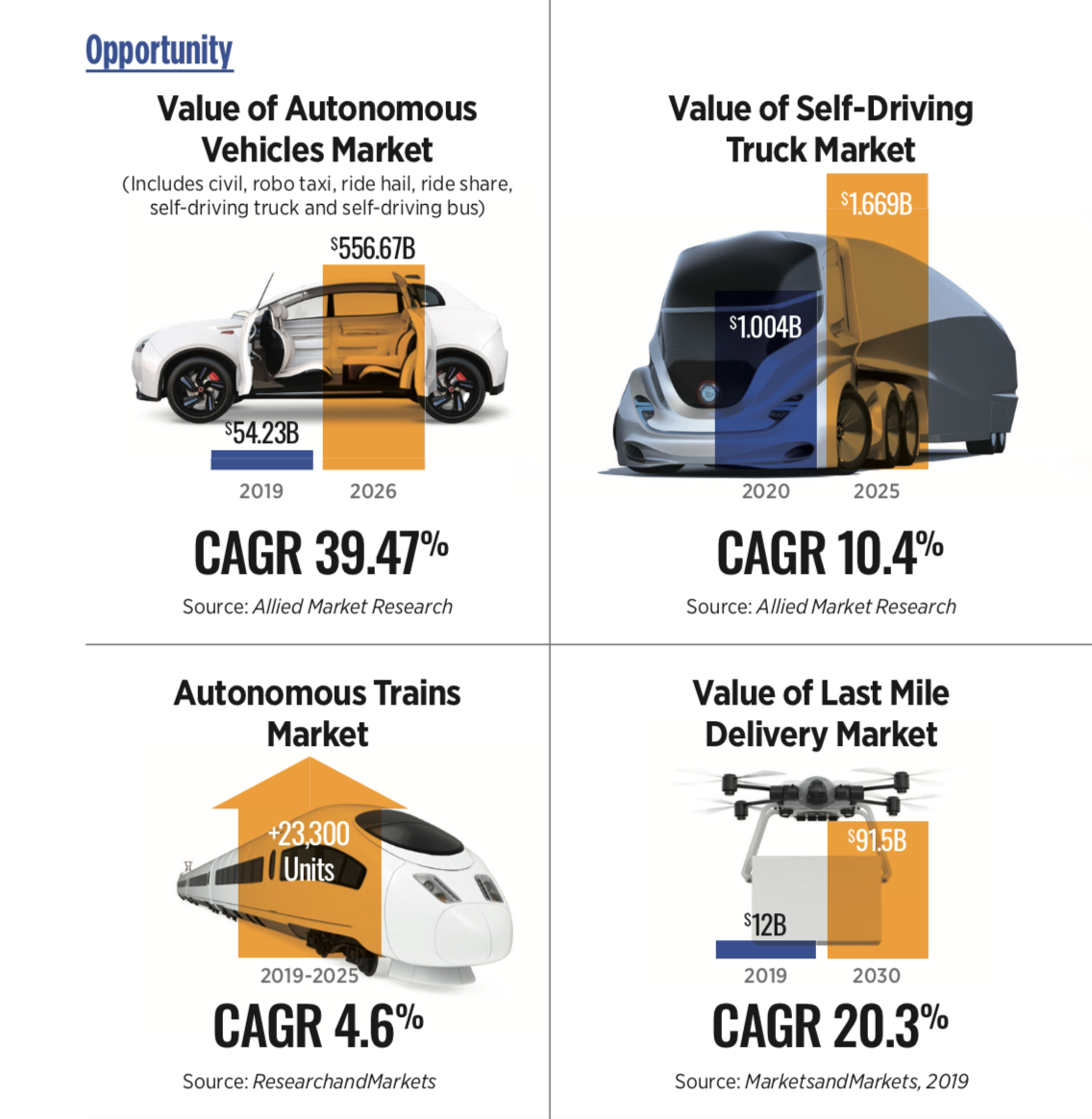

AUTOMOTIVE: NEW PLAYERS, BUSINESS MODELS, CHALLENGES

Allied Market Research reports that the autonomous vehicle market will exceed $556 billion by 2025. The opportunity has attracted a large number of start-ups, and that means disruption for traditional OEMs and their supply chain, as well as for mobility service providers such as Uber and Lyft. New business models are needed to satisfy customer demand for mobility as a service (MaaS), when drivers are no longer needed and vehicles are continuously available. Already, 1 billion people worldwide live with a disability and 143 million are older than 80, and the number of elderly is expected to reach 426 million by 2050. At the same time, there are many unknowns about who will own and service the vehicles for MaaS. There are even larger questions for cities about the impact on mass transit and the current transportation infrastructure.

Autonomous technology, Carlson said, will continue to advance without any huge infrastructure investments, although increasing levels of connectivity will enhance autonomous travel. “If we are waiting for connected and highly sophisticated infrastructure, we are not going to get there,” he said.

IHS Markit predicts that the U.S. will be the first market for autonomous vehicles in 2020; by 2040, U.S. sales are expected to reach 7.4 million units per year. China is forecast to reach 14.5 million in automobile sales by 2040. In Europe, regulations impede ride-hailing services, so that market will rely on personally-owned autonomous vehicles. Vehicle sales in Europe are forecast to reach 5.5 million units by 2040.

The IHS Markit forecast foresees partnerships and ecosystems forming around technology and services that will help the industry address the complex challenges affecting the evolution of autonomous mobility. The industry will shift from focusing on unit sales to usage per distance or time.

TRUCKING: MOVING FREIGHT AUTONOMOUSLY

Similar disruption is expected in the trucking industry, where the market for autonomous trucks is expected to grow at a rate of 10.4 percent annually through 2025, according to Allied Market Research.

“The components of full autonomy, such as emergency braking and lane centering, can be found on Level 2 trucks that are on the road today,” said U.S.-based trucking industry journalist Steve Sturgess. A number of Level 4 trucks are now being tested in various applications around the world (see “Additional Players in Autonmous Trucks” on page 56). Sturgess expects Level 4 technology to be on the road within two years (but not without drivers). He believes the first commercial uses will be on interstate highways, where navigation challenges are far less complex than with city driving. Autonomous features will improve the productivity and safety of drivers, allowing them to take on other tasks while the vehicle keeps moving.

Further into the future, companies such as Tesla envision truck platoons, with a human driver in the lead vehicle followed by two or more autonomous trucks. Others see near-term opportunities within ports and other private facilities. Several OEMs see a need to become solution providers rather than be solely focused on truck technology.

AUTONOMOUS TRAINS: ALREADY PROVEN

As more people move into the cities, trains can play a central role in reducing congestion. According to the International Association of Public Transport, autonomous trains allow operators to optimize running time, increase speeds, and reduce spacing, and time spent in stations, all while improving safety and flexibility.

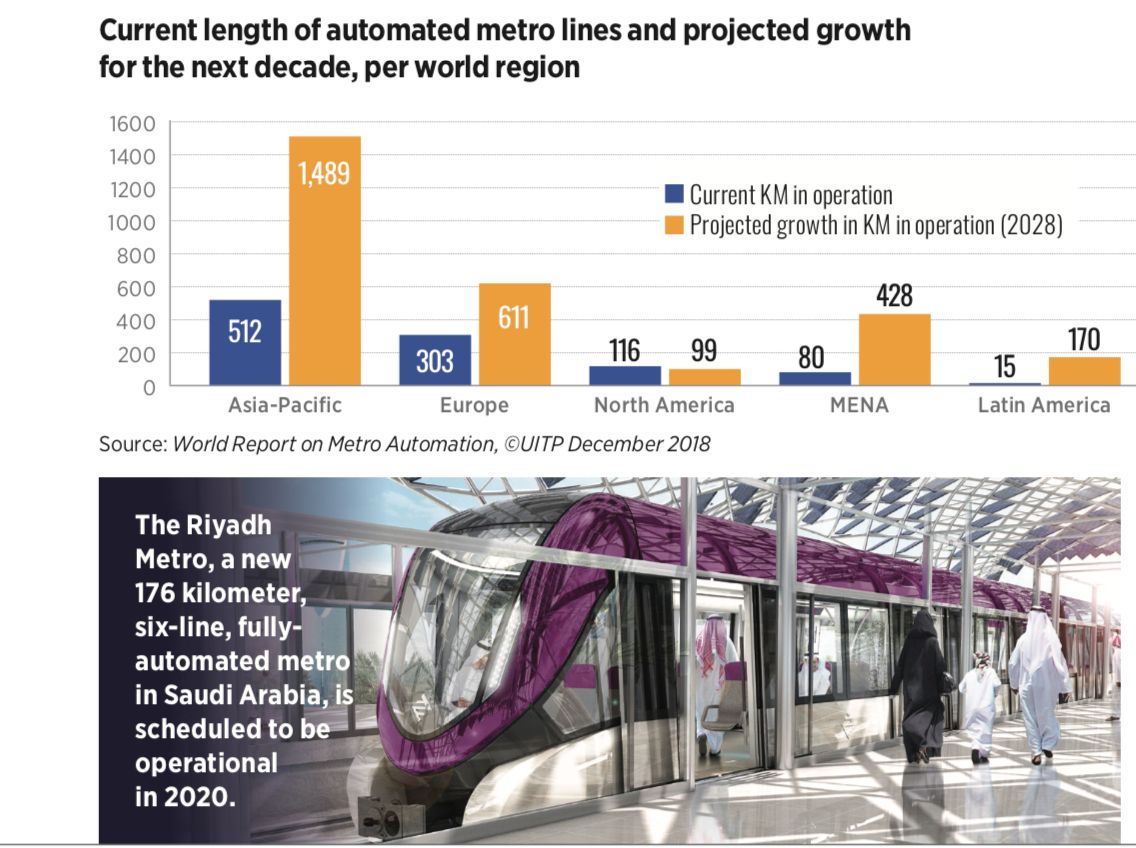

Autonomous trains are a proven technology; as of December 2018, nearly a quarter of the world’s metro systems had at least one fully automated line in operation. By 2023 the number of automated metro kilometers in the world is set to triple, with most of the growth taking place in China. By 2022, full automation is expected to become the mainstream design for new metro lines, increasing from the current 10 percent of metro infrastructure in planning and construction to 48 percent.

It is an exciting time to be part of the transportation industry as autonomous technology evolves to reshape our world.